Table of Contents

- Executive Summary: The 2025 Landscape of Cosmic Muon Spectrometry

- Core Technologies and Recent Breakthroughs

- Key Industry Players and Collaborative Initiatives

- Market Size, Growth Forecasts (2025–2030), and Investment Trends

- Principal Applications: Security, Geology, Industry, and Beyond

- Competitive Analysis: Differentiators in Hardware and Software

- Regulatory and Standards Evolution (IEEE, IAEA, etc.)

- Challenges and Barriers to Widespread Adoption

- Emerging Research, Patents, and Academic-Industry Partnerships

- Future Outlook: Next-Gen Innovations and Strategic Opportunities

- Sources & References

Executive Summary: The 2025 Landscape of Cosmic Muon Spectrometry

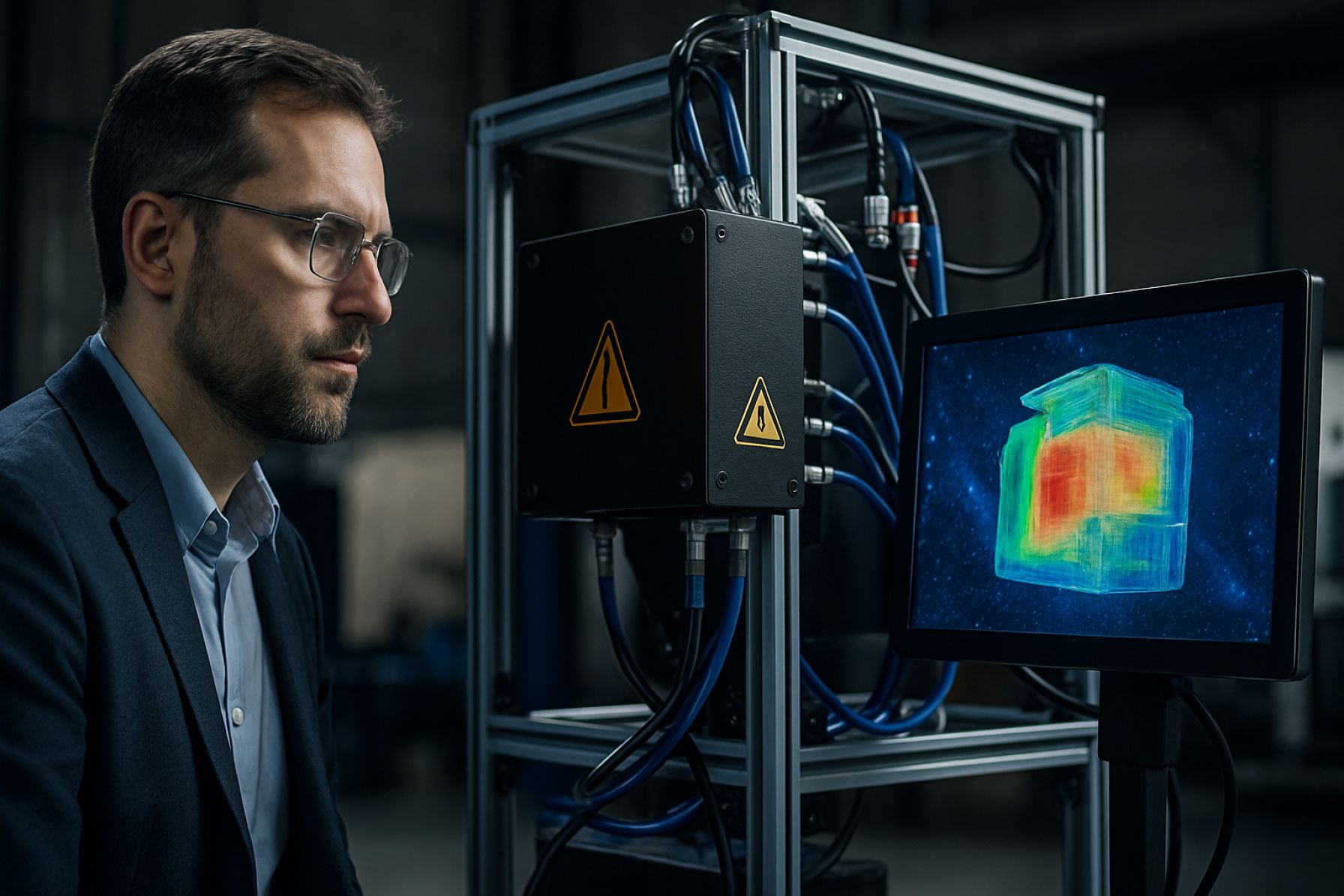

Cosmic muon spectrometry, a field leveraging the penetrating power of cosmic-ray muons for non-invasive imaging and material characterization, is poised for notable advancements in 2025 and the following years. The ongoing integration of advanced detector technology, data analytics, and scalable deployment is transforming both scientific research and industrial applications.

In 2025, leading initiatives in cosmic muon spectrometry are driven by sustained investments in detector innovation. The European Organization for Nuclear Research (CERN) and its global collaborators continue to refine large-area, high-resolution muon tracking systems, crucial for both particle physics experiments and real-world imaging solutions. These systems increasingly employ resistive plate chambers and scintillating fiber trackers, enhancing sensitivity and reliability.

On the industrial front, organizations such as Avalon Detectors and AMUON are commercializing cosmic muon spectrometers for applications ranging from cargo scanning to geological prospecting. Real-time muon tomography is now being deployed at critical infrastructure sites, where it provides non-destructive inspection of dense and shielded objects, outperforming traditional X-ray and gamma imaging in terms of penetration depth and safety.

Recent data from ongoing pilot projects confirm the technology’s maturity and cost-effectiveness. For example, during 2024, muon tomography was successfully used to verify the integrity of nuclear waste storage at several facilities, as reported by National Nuclear Laboratory. The next few years will see expanded deployments in border security, mining exploration, and civil engineering, with field trials measuring both detection accuracy and operational throughput under diverse environmental conditions.

Looking forward, the outlook for cosmic muon spectrometry is defined by two converging trends: miniaturization of detection platforms and the integration of artificial intelligence for automated anomaly detection and material discrimination. Initiatives spearheaded by RIKEN and other research consortia focus on portable muon detectors and cloud-based data processing, aiming to lower operational barriers and enable broader adoption.

In summary, 2025 marks a pivotal year for cosmic muon spectrometry, with robust data supporting its utility and a clear path toward wider commercialization. Technology providers and research institutions are set to drive further breakthroughs, ensuring the field’s continued growth across scientific and industrial domains.

Core Technologies and Recent Breakthroughs

Cosmic muon spectrometry has made significant technological advances as it matures into a practical tool for non-destructive imaging and material characterization. The technique, which leverages naturally occurring muons generated by cosmic rays, is being actively developed and deployed for applications ranging from nuclear material detection to geological exploration and industrial inspection.

Since 2023, several core technologies have reached pivotal milestones. Next-generation muon tracking detectors, including plastic scintillators, resistive plate chambers, and multi-wire proportional chambers, have improved spatial resolution and tracking efficiency. For example, the CEA (Commissariat à l’énergie atomique et aux énergies alternatives, France) has developed compact muon trackers that enable field-deployable systems for imaging large civil engineering structures. Similarly, RIKEN in Japan has advanced portable muon imaging devices, focusing on fast event reconstruction and robust data processing for rapid deployment in disaster response scenarios.

On the data acquisition front, the integration of silicon photomultipliers (SiPMs) and high-throughput digital electronics has accelerated event collection and reduced background noise. These improvements are evident in commercial systems provided by Lucid Dynamics, which specialize in muon tomography solutions for detecting shielded nuclear materials and assessing critical infrastructure. Their systems now routinely collect and analyze millions of muon events daily, enabling three-dimensional reconstructions with sub-meter resolution.

In terms of recent breakthroughs, one of the most notable has been the deployment of cosmic muon spectrometers for volcano monitoring and safeguarding nuclear waste repositories. The INFN Gran Sasso National Laboratory has demonstrated the use of muon spectrometry to image the interior of Mt. Vesuvius, refining risk assessment models for volcanic eruptions. Simultaneously, the Sandia National Laboratories are working on integrating muon spectrometry into site monitoring protocols for secure nuclear waste storage, providing a non-invasive verification tool.

Looking ahead to 2025 and beyond, key challenges remain in scaling up detector arrays for broader coverage, automating data analysis using artificial intelligence, and reducing deployment costs. Ongoing collaborations, such as those led by Science and Technology Facilities Council (STFC) in the UK, focus on embedding muon spectrometers in routine civil engineering inspections and mining surveys. With increased support for R&D and the translation of lab-scale breakthroughs into rugged commercial systems, the field is poised for widespread adoption across security, energy, and earth sciences sectors through the remainder of the decade.

Key Industry Players and Collaborative Initiatives

The field of cosmic muon spectrometry has seen significant industrial advancement and collaborative momentum as of 2025, with a number of key players driving technological innovation and deployment. These stakeholders range from established detector manufacturers to innovative startups and national laboratories, each contributing to the rapid evolution of muon-based detection systems for applications spanning civil engineering, nuclear safety, and geological exploration.

Among the prominent industry players, Hamamatsu Photonics continues to be a cornerstone in photodetector technologies, providing advanced photomultiplier tubes and silicon photomultipliers crucial for muon detection modules. Their components are frequently integrated into large-scale spectrometry systems, offering high sensitivity and reliability for both stationary and portable muon imaging solutions.

In the realm of turnkey muon imaging solutions, Lynkeos Technology has expanded its suite of muon tomography instruments, notably for non-destructive inspection of nuclear waste containers and monitoring of critical infrastructure. Their close collaborations with UK nuclear and research agencies have positioned their muon spectrometers as benchmarks in regulatory compliance and operational safety.

The European research infrastructure has also played a pivotal role, with organizations such as CERN spearheading collaborative experiments and technology transfer programs. Through initiatives like the CERN Knowledge Transfer group, detector designs originally developed for high-energy physics are being adapted for commercial muon tomography, fostering a robust ecosystem of startups and spin-offs.

On the North American front, Pacific Northwest National Laboratory (PNNL) is advancing field-deployable cosmic muon detectors for security and nonproliferation applications, focusing on rapid characterization of shielded containers and critical infrastructure. These efforts are often in partnership with industrial entities and government agencies, enhancing the readiness of muon spectrometry for operational deployment.

Looking ahead, the next few years are expected to see deeper cross-sector collaborations, particularly in infrastructure monitoring, mining, and environmental surveying. Industry consortia and public-private partnerships are anticipated to drive standardization and interoperability of muon spectrometry systems. Additionally, as manufacturers such as Orca Group and Senstech enhance their portfolio of precision sensors and data acquisition modules, the market is poised for broader commercial adoption and integration into digital twin frameworks for smart infrastructure.

Market Size, Growth Forecasts (2025–2030), and Investment Trends

The market for cosmic muon spectrometry is poised for notable growth over the 2025–2030 period, driven by increasing demand from sectors such as geological surveying, security, and high-energy physics. In 2025, the global market remains relatively niche but is expanding, as the unique capabilities of muon tomography—such as imaging through dense materials—are finding new applications in both academic and industrial contexts.

Key players such as AMSC Instruments, Thermo Fisher Scientific, and research-driven entities like CERN and the Brookhaven National Laboratory are actively developing and deploying muon spectrometry solutions. These organizations are investing in advanced detector arrays, improved data analysis algorithms, and portable muon imaging systems. For instance, Muon Solutions has recently highlighted new contracts for geological exploration and critical infrastructure inspection, indicating rising commercial interest.

From 2025 through 2030, industry forecasts suggest a compound annual growth rate (CAGR) in the low double digits, fueled by several converging trends:

- Wider adoption in mining and exploration, as muon spectrometry enables non-invasive mapping of ore bodies and voids, minimizing environmental impact. Companies like Muon Group are piloting projects with leading mining firms.

- Increased government and institutional investment in border security and nuclear material monitoring, where muon technology aids in detecting shielded contraband and nuclear threats, as demonstrated by partnerships involving Los Alamos National Laboratory and Sandia National Laboratories.

- Expanding use of cosmic muon detectors for civil engineering, archaeology, and volcanology, with institutions such as University College London collaborating on international research projects.

Investment trends indicate increased venture capital activity and public-private partnerships. In 2024 and early 2025, funding rounds and grants have focused on startups developing portable or cost-effective muon detectors, as well as on enhancing data processing capabilities through AI and cloud computing—areas advanced by companies like Muons Technologies.

Looking ahead, the outlook through 2030 is optimistic. Market maturation is expected to lower costs and increase accessibility, while expanding use cases will continue to attract new investment. The sector’s growth trajectory, though from a modest base, positions cosmic muon spectrometry as an emerging technology with significant long-term potential.

Principal Applications: Security, Geology, Industry, and Beyond

Cosmic muon spectrometry, leveraging the penetrating power of naturally occurring cosmic-ray muons, has advanced from experimental physics to a range of practical applications across security, geology, and industrial domains. As of 2025, the deployment of muon detectors is accelerating, driven by both technological improvements and pressing societal needs for safer, non-invasive inspection methods.

In security, muon tomography systems are increasingly utilized for cargo and vehicle scanning at ports and border crossings, offering the unique ability to detect high-Z (high atomic number) materials such as uranium or plutonium, which are challenging for conventional X-ray scanners. For example, Rapiscan Systems has introduced muon imaging solutions capable of screening densely packed or shielded containers, significantly enhancing interdiction capabilities while maintaining throughput. Similarly, Los Alamos National Laboratory is advancing field-deployable muon radiography prototypes, focusing on rapid threat identification in real-world environments.

The geological sector has seen expanded use of muon spectrometry for subsurface imaging. This includes monitoring volcanic activity, mapping ore bodies, and surveying critical infrastructure such as dams. For instance, Muon Solutions Oy has deployed muography devices for 3D imaging of volcanoes and mining sites, providing continuous, real-time data for risk mitigation and resource assessment. In 2024–2025, collaborations between geoscience institutes and technology companies are poised to increase, with ongoing pilot projects in Europe and Asia pushing for wider adoption.

- Industrial applications are broadening as well. Muon spectrometry is now used for non-destructive inspection of large, shielded structures—such as nuclear waste storage casks and blast furnaces—where traditional methods are impractical. Kyoto University continues to refine large-area muon detectors for industrial safety and maintenance, partnering with utilities and heavy industry.

- Outlook: Looking ahead to 2025 and beyond, the field is moving toward miniaturization, cost reduction, and cloud-based data analytics. Increased standardization and the entry of new manufacturers are expected, facilitating broader integration into smart infrastructure, border security, and critical asset monitoring. With ongoing R&D by organizations such as Science and Technology Facilities Council (STFC), muon spectrometry is likely to become a mainstay in high-value inspection and monitoring platforms worldwide.

Competitive Analysis: Differentiators in Hardware and Software

Cosmic muon spectrometry is rapidly evolving, with competition intensifying among hardware manufacturers and software developers as the demand for non-invasive subsurface imaging and security screening grows. In 2025, key differentiators among industry players center on detection hardware sensitivity, scalability, data acquisition speed, and advanced software for tomographic reconstruction and automated analysis.

On the hardware front, manufacturers are prioritizing the development of highly sensitive, large-area detectors capable of operating in diverse environments. Companies such as Hamamatsu Photonics have advanced the use of silicon photomultipliers and scintillator panels, offering compact, robust modules with low power consumption and high detection efficiency. Meanwhile, ADA Space and Cosmic Shielding Corporation are focusing on lightweight, modular detector arrays designed for portability and rapid deployment, which are particularly attractive for geological surveys and security applications.

A primary competitive edge is the integration of real-time data acquisition and high-throughput electronics, reducing latency in muon track reconstruction. For example, Muography Research Organization has implemented FPGA-based readout systems that enable near-instantaneous event capture and pre-processing, supporting high-resolution imaging even in high-background environments. The ability to scale detector arrays without compromising data integrity is another key differentiator, with companies investing in robust synchronization and time-stamping solutions.

Software differentiation is equally significant. Industry leaders are incorporating machine learning and AI-driven algorithms to enhance muon tomography and automate anomaly detection. Oxford Instruments and IMDETEX have released proprietary software suites that provide user-friendly interfaces, 3D visualization tools, and advanced statistical analysis, facilitating rapid interpretation by non-specialist users. The implementation of cloud-based platforms for remote monitoring and collaboration is also gaining traction, enabling stakeholders to access and analyze data in near real-time from disparate locations.

Looking towards the next few years, competitive advantage will likely hinge on the seamless integration of hardware-software ecosystems, enabling end-to-end solutions tailored to specific verticals such as civil engineering, nuclear waste monitoring, and border security. Open-source initiatives and standardization efforts, such as those supported by CERN, are expected to accelerate innovation and interoperability, encouraging new entrants and partnerships. The sector is poised for continued investment in AI-enhanced analytics and ruggedized, scalable detector systems as end-user requirements become more sophisticated and global deployment expands.

Regulatory and Standards Evolution (IEEE, IAEA, etc.)

Cosmic muon spectrometry, a technique leveraging naturally occurring atmospheric muons for imaging and material discrimination, is gaining significant regulatory and standards attention as its applications expand in security, civil engineering, and nuclear safety. In 2025, the evolution of standards is characterized by increased cross-sectoral collaboration and the involvement of global technical bodies such as the Institute of Electrical and Electronics Engineers (IEEE) and the International Atomic Energy Agency (IAEA).

The IEEE Nuclear and Plasma Sciences Society continues to support the development of consensus standards for instrumentation, data acquisition, and calibration protocols in muon detection systems. In 2025, working groups under the IEEE Nuclear Science Symposium are updating guidelines for the interoperability of detector electronics, data formats, and time synchronization—facilitating multi-site and multinational muon imaging projects. These updates reflect the growing deployment of cosmic muon spectrometers for infrastructure monitoring and cargo screening, where consistent data quality and traceability are imperative.

Simultaneously, the IAEA is actively engaging with member states to establish best practices for the use of muon spectrometry in nuclear material verification, spent-fuel storage monitoring, and non-proliferation initiatives. In 2025, the IAEA is piloting draft technical documents on the validation and qualification of cosmic muon tomography for safeguarding spent nuclear fuel casks, with field tests underway in collaboration with national laboratories and industry partners. These documents are expected to form the basis for harmonized regulatory guidance in the coming years, addressing requirements for detector sensitivity, background rejection, and long-term operational reliability.

Moreover, new standards for environmental safety and data privacy are under development, particularly as muon spectrometry is adopted for critical infrastructure inspection in urban areas. Industry consortia, such as the National Electrical Manufacturers Association (NEMA), are contributing to draft specifications on electromagnetic compatibility and device safety, aligning with international regulatory expectations and supporting global market access.

Looking ahead to the next few years, the regulatory landscape for cosmic muon spectrometry is poised for further formalization. The anticipated publication of harmonized standards and technical reports by organizations like the IEEE and IAEA will accelerate the technology’s adoption across regulated sectors. This process is expected to enable broader deployment in safety-critical domains while ensuring public trust, data integrity, and international interoperability.

Challenges and Barriers to Widespread Adoption

Cosmic muon spectrometry has made significant strides as a tool for non-invasive imaging and material characterization across fields such as nuclear security, civil engineering, and geological exploration. However, several key challenges continue to hamper its widespread adoption as of 2025, with implications for the pace at which this technology can be integrated into mainstream applications in the coming years.

One major barrier remains the high cost and complexity of detector systems. Most muon spectrometers rely on advanced detection technologies, such as scintillators, resistive plate chambers, or gas-based tracking systems. These require precise calibration, stable operation under varying environmental conditions, and substantial investment in both hardware and skilled personnel. For example, the Hamamatsu Photonics and Saint-Gobain supply scintillator and photodetector components, but the integration of these into robust, field-deployable systems remains expensive and technically demanding.

Another challenge is the relatively low flux of cosmic muons at ground level, which results in long data acquisition times for high-resolution imaging, especially for large or dense objects. This limitation hinders applications requiring real-time or near-real-time analysis, such as disaster response or rapid infrastructure assessment. Efforts to increase detector area and sensitivity, as seen in prototypes developed by CEA and TRIUMF, may partially alleviate this issue, but at the cost of further increasing system size and complexity.

Data interpretation and image reconstruction also present significant technical barriers. Transforming raw muon track data into actionable three-dimensional images requires sophisticated algorithms and substantial computational resources. While organizations like Los Alamos National Laboratory and CERN have demonstrated advanced tomographic techniques, transferring these capabilities to user-friendly, commercial systems remains a work in progress.

Regulatory and logistical considerations further complicate deployment. In sectors like nuclear safeguards, systems must meet stringent certification requirements and operate reliably in challenging environments. Transportation of sensitive detection equipment, especially across borders, may be impeded by export controls or safety regulations overseen by bodies such as the International Atomic Energy Agency (IAEA).

Looking ahead, addressing these challenges will require continued collaboration between detector manufacturers, research institutes, and end-users. Advances in solid-state sensor technology, cost reduction through scaling, and the development of standardized, modular systems are likely to be key enabling factors for broader adoption of cosmic muon spectrometry in the next several years.

Emerging Research, Patents, and Academic-Industry Partnerships

The field of cosmic muon spectrometry has seen significant advancements entering 2025, driven by collaborative efforts between academic institutions and industry, as well as a growing patent landscape. The demand for non-invasive imaging in civil engineering, nuclear safety, and advanced materials research has positioned cosmic muon spectrometry as a strategic focus for innovation and commercialization.

Recent years have witnessed a notable increase in emerging research projects, particularly in Europe and Asia. For instance, the European Organization for Nuclear Research (CERN) continues to leverage cosmic muon detection technologies through its collaborations on particle tracking and infrastructure monitoring. Similarly, the University of Tokyo is actively developing muon imaging systems for geological and archaeological applications, often partnering with Japanese technology firms for sensor development and scaling.

Patent activity in this domain is accelerating. Technology manufacturers such as Hamamatsu Photonics and KETEK GmbH have secured patents for advanced photodetectors and silicon photomultiplier arrays optimized for muon tracking in harsh environments. These advances are integral to improving sensitivity and resolution in spectrometric systems, and many are transitioning from laboratory prototypes to robust commercial products.

Emerging partnerships between academia and industry are shaping the near-term outlook. Notably, ANSYS, Inc. is collaborating with research universities to model and optimize muon tomography systems using advanced simulation platforms, accelerating both design cycles and deployment across new sectors. Meanwhile, the Oak Ridge National Laboratory in the United States is working with engineering firms to test large-area muon detectors for nuclear material monitoring and spent fuel verification.

Looking ahead, the sector is poised for wider adoption and cross-sectoral integration. With governments and infrastructure operators increasingly interested in non-destructive evaluation technologies, further joint ventures and public-private partnerships are expected. Enhanced detector miniaturization, lower-cost manufacturing, and improved data analytics—facilitated by the above partnerships—should drive both the deployment and new intellectual property filings through 2025 and beyond. The synergy between academic innovation and industrial scale-up is likely to yield new commercial products and applications, expanding the reach of cosmic muon spectrometry across scientific, security, and industrial domains.

Future Outlook: Next-Gen Innovations and Strategic Opportunities

The field of cosmic muon spectrometry is poised for significant advancements over the next several years, driven by both technological innovation and rising demand across sectors such as geology, nuclear safety, and infrastructure monitoring. As of 2025, research and commercial deployments are accelerating, with a focus on improving detector sensitivity, portability, and data processing capabilities.

Leading-edge projects are harnessing advances in scintillator materials, silicon photomultipliers, and real-time data analytics. For example, the European Organization for Nuclear Research (CERN) continues to refine large-area muon detection arrays, supporting geophysical imaging and fundamental physics. Meanwhile, companies like Muon Solutions Oy are commercializing portable muon tomography systems for applications such as volcano monitoring and mineral exploration, leveraging improvements in detector miniaturization and ruggedization.

Recent events highlight a growing emphasis on field-deployable systems. In 2024, Lawrence Berkeley National Laboratory demonstrated a new compact muon detector platform designed for remote geological surveys, with plans for broader deployment in 2025 and beyond. Similarly, Tokyo Instruments, Inc. has announced further investment in the development of automated, high-resolution muon tracking modules, targeting both academic and industrial users.

Data integration and interpretation remain key frontiers. The next generation of spectrometers is expected to feature enhanced machine learning algorithms for particle identification and noise reduction, enabling faster and more accurate 3D imaging of subsurface structures. Murata Manufacturing Co., Ltd. is actively researching embedded AI processors for real-time muon data analytics, anticipating prototype releases by late 2025.

Strategic opportunities are also arising from increased governmental interest in non-invasive inspection technologies. Initiatives within the U.S. Department of Energy and the Japan Atomic Energy Agency are funding the integration of cosmic muon spectrometry for nuclear material monitoring and infrastructure assessment. This is expected to stimulate further collaboration between research institutions, detector manufacturers, and end-users, driving innovation pipelines and market expansion.

In summary, the outlook for cosmic muon spectrometry through 2025 and the following years is characterized by rapid technological progress, expanding application domains, and increased cross-sector partnerships. These trends position the field for impactful deployments in both scientific research and critical real-world sensing challenges.

Sources & References

- European Organization for Nuclear Research (CERN)

- RIKEN

- RIKEN

- INFN Gran Sasso National Laboratory

- Sandia National Laboratories

- Hamamatsu Photonics

- Lynkeos Technology

- CERN

- Pacific Northwest National Laboratory

- Orca Group

- AMSC Instruments

- Brookhaven National Laboratory

- Los Alamos National Laboratory

- University College London

- Rapiscan Systems

- Muon Solutions Oy

- Kyoto University

- ADA Space

- Cosmic Shielding Corporation

- Oxford Instruments

- IMDETEX

- Institute of Electrical and Electronics Engineers (IEEE)

- International Atomic Energy Agency (IAEA)

- National Electrical Manufacturers Association (NEMA)

- TRIUMF

- KETEK GmbH

- Oak Ridge National Laboratory

- Murata Manufacturing Co., Ltd.

- Japan Atomic Energy Agency