Aluminum-Lithium Alloy Additive Manufacturing in 2025: Unleashing Lightweight Innovation and Transforming Aerospace & Beyond. Explore the Next 5 Years of Breakthroughs, Market Growth, and Competitive Shifts.

- Executive Summary: 2025 Outlook and Key Takeaways

- Market Size, Growth Rate, and 2025–2030 Forecasts

- Technology Landscape: Additive Manufacturing Methods for Al-Li Alloys

- Key Players and Strategic Initiatives (e.g., Boeing, Airbus, Alcoa) [Sources: boeing.com, airbus.com, alcoa.com]

- Material Properties and Performance Advantages

- Adoption Drivers: Aerospace, Automotive, and Emerging Sectors

- Challenges: Printability, Cost, and Supply Chain Constraints

- Recent Innovations and R&D Trends [Sources: nasa.gov, tms.org]

- Regulatory Standards and Certification Pathways [Sources: faa.gov, easa.europa.eu]

- Future Outlook: Disruptive Potential and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Outlook and Key Takeaways

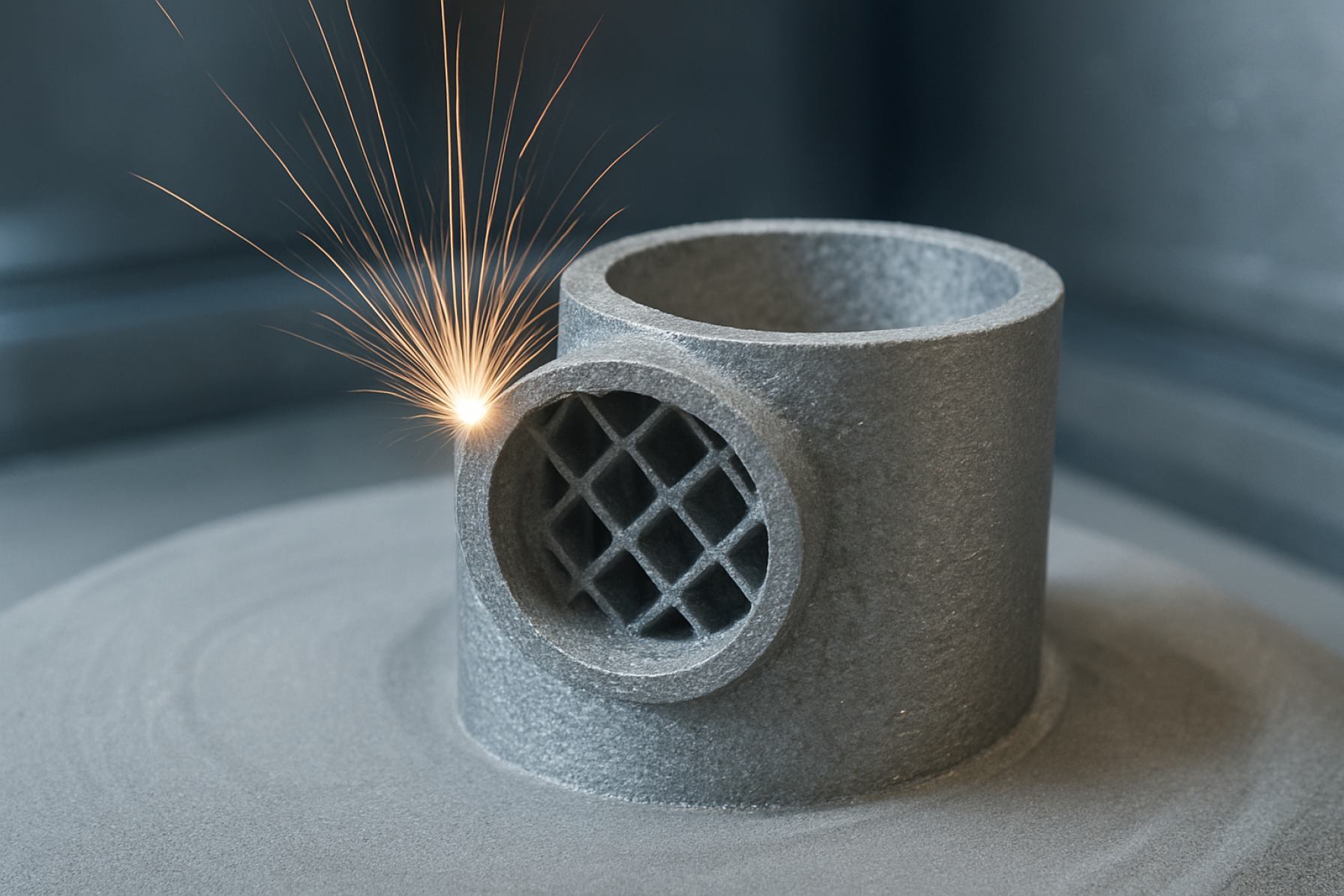

The landscape of aluminum-lithium (Al-Li) alloy additive manufacturing (AM) is poised for significant evolution in 2025, driven by aerospace, defense, and advanced transportation sectors seeking lightweight, high-strength solutions. Al-Li alloys, prized for their superior strength-to-weight ratio and fatigue resistance, are increasingly being adapted for AM processes such as selective laser melting (SLM) and electron beam melting (EBM). This shift is catalyzed by the need for rapid prototyping, complex geometries, and material efficiency in high-performance applications.

Key industry players are intensifying their focus on Al-Li AM. Airbus continues to invest in additive manufacturing for structural aircraft components, with ongoing research into Al-Li alloys to further reduce airframe weight and improve fuel efficiency. Boeing is similarly advancing its AM capabilities, exploring Al-Li alloys for both commercial and defense platforms. These efforts are supported by material suppliers such as Constellium, a leading producer of advanced aluminum and Al-Li alloys, which collaborates with OEMs to develop AM-optimized feedstocks.

In 2025, the availability of Al-Li alloy powders specifically engineered for AM is expected to expand, with companies like AMG Advanced Metallurgical Group and Kymera International scaling up production. These powders are tailored for high flowability and consistent microstructure, addressing previous challenges of cracking and porosity in AM-processed Al-Li parts. The SAE International and NASA are actively involved in standardizing testing protocols and qualification pathways, which is expected to accelerate certification for flight-critical components.

Looking ahead, the next few years will likely see Al-Li AM transition from prototyping to serial production, particularly in aerospace and space launch systems. The integration of digital design, simulation, and in-situ process monitoring is anticipated to further enhance part quality and repeatability. Strategic partnerships between OEMs, powder producers, and AM machine manufacturers—such as EOS and GE—are expected to drive innovation in process parameters and post-processing techniques.

In summary, 2025 marks a pivotal year for aluminum-lithium alloy additive manufacturing, with expanding material options, maturing process controls, and growing adoption in mission-critical applications. The sector’s trajectory points toward broader industrialization, underpinned by collaborative R&D and a robust push for certification and standardization.

Market Size, Growth Rate, and 2025–2030 Forecasts

The market for aluminum-lithium (Al-Li) alloy additive manufacturing (AM) is poised for significant growth between 2025 and 2030, driven by the aerospace, defense, and advanced transportation sectors’ increasing demand for lightweight, high-strength components. Al-Li alloys, prized for their superior strength-to-weight ratio and corrosion resistance, are particularly attractive for 3D printing of structural parts in aircraft, satellites, and high-performance vehicles.

As of 2025, the adoption of Al-Li alloy AM remains in its early commercialization phase, with key industry players investing in process development and qualification. Major aerospace manufacturers such as Airbus and Boeing have publicly highlighted the strategic importance of additive manufacturing for next-generation airframes, with Al-Li alloys being a focus due to their weight-saving potential. Airbus has previously incorporated Al-Li alloys in conventionally manufactured aircraft parts and is actively exploring AM for further design optimization and cost reduction.

On the materials and technology supply side, companies like Constellium and Arconic are among the leading producers of advanced Al-Li alloys, supplying powders and feedstock tailored for additive processes. EOS and 3D Systems are developing and qualifying AM systems capable of processing these alloys, focusing on powder bed fusion and directed energy deposition technologies. These companies are collaborating with aerospace OEMs to validate the mechanical properties and repeatability of Al-Li AM parts, a critical step for broader adoption.

While the current market size for Al-Li alloy AM is relatively modest compared to traditional aluminum AM, it is expected to expand rapidly. Industry sources anticipate a compound annual growth rate (CAGR) in the double digits through 2030, as qualification barriers are overcome and production moves from prototyping to serial manufacturing. The increasing availability of high-quality Al-Li powders, improvements in process control, and the push for sustainable, lightweight solutions in aviation and space are key growth drivers.

Looking ahead, the period from 2025 to 2030 will likely see the first certified, flight-critical Al-Li AM components entering service, particularly in commercial and defense aerospace. The market outlook is further bolstered by ongoing R&D investments from both material suppliers and AM system manufacturers, as well as the growing emphasis on digital manufacturing and supply chain resilience. As these trends converge, Al-Li alloy additive manufacturing is set to become a cornerstone technology for high-performance, weight-sensitive applications.

Technology Landscape: Additive Manufacturing Methods for Al-Li Alloys

The technology landscape for additive manufacturing (AM) of aluminum-lithium (Al-Li) alloys is rapidly evolving as aerospace, defense, and advanced manufacturing sectors seek lightweight, high-strength components. As of 2025, the focus is on overcoming the unique challenges posed by Al-Li alloys—such as their high reactivity, tendency for hot cracking, and sensitivity to process parameters—while leveraging the benefits of AM for complex geometries and material efficiency.

The most prominent AM methods for Al-Li alloys are powder bed fusion (PBF), particularly laser-based (LPBF) and electron beam (EBM) variants, and directed energy deposition (DED). LPBF remains the leading technique due to its fine resolution and suitability for intricate aerospace parts. However, the process window for Al-Li alloys is narrow, requiring precise control of laser power, scan speed, and atmosphere to prevent defects. Companies like EOS and Siemens are actively developing process parameters and in-situ monitoring systems to address these issues, with EOS offering specialized powder management and closed-loop control for reactive alloys.

Material suppliers such as 3D Systems and APWORKS are expanding their portfolios to include Al-Li alloy powders optimized for AM, focusing on particle size distribution, flowability, and minimal oxygen content. These powders are tailored for high-performance applications, particularly in aerospace, where weight reduction is critical. APWORKS, a subsidiary of Airbus, is notable for its work in developing and qualifying Al-Li powders for serial production.

Electron beam melting (EBM), offered by GE Additive (through its Arcam brand), is gaining traction for larger Al-Li components due to its ability to process reactive materials in a vacuum, reducing oxidation and cracking. DED, supported by companies like TRUMPF, is being explored for repair and hybrid manufacturing, allowing the addition of Al-Li features to existing parts.

Looking ahead, the next few years will see increased collaboration between OEMs, powder suppliers, and AM system manufacturers to qualify Al-Li alloys for flight-critical applications. Standardization efforts, led by industry bodies such as SAE International, are expected to accelerate, focusing on material specifications, process qualification, and part certification. The outlook is optimistic: as process control and material quality improve, Al-Li AM is poised to transition from prototyping to serial production, particularly in aerospace and defense sectors where weight savings translate directly to performance and cost benefits.

Key Players and Strategic Initiatives (e.g., Boeing, Airbus, Alcoa) [Sources: boeing.com, airbus.com, alcoa.com]

The landscape of aluminum-lithium (Al-Li) alloy additive manufacturing (AM) is being shaped by a select group of aerospace giants and advanced materials producers, each leveraging their expertise to drive innovation and adoption in this sector. As of 2025, the strategic focus is on qualifying Al-Li alloys for critical aerospace applications, scaling up production, and integrating AM into mainstream manufacturing workflows.

Boeing remains at the forefront of Al-Li alloy AM, building on its legacy of pioneering lightweight structures for commercial and defense aircraft. The company has invested in research partnerships and in-house development to qualify Al-Li alloys for powder bed fusion and directed energy deposition processes. Boeing’s initiatives are aimed at reducing component weight, improving fuel efficiency, and enabling more complex geometries that are difficult to achieve with traditional manufacturing. The company’s ongoing collaboration with leading AM equipment suppliers and materials producers is expected to accelerate the certification of Al-Li AM parts for next-generation aircraft platforms in the coming years (Boeing).

Airbus is similarly advancing the use of Al-Li alloys in additive manufacturing, with a particular emphasis on sustainability and lifecycle performance. Airbus has announced several pilot projects and demonstrator components utilizing Al-Li alloys, targeting both structural and non-structural applications. The company’s strategic initiatives include partnerships with powder manufacturers and AM technology providers to optimize alloy compositions for printability and mechanical performance. Airbus’s roadmap for 2025 and beyond includes scaling up the use of Al-Li AM parts in commercial aircraft, with a focus on reducing material waste and supporting circular economy goals (Airbus).

On the materials supply side, Alcoa (now operating as Howmet Aerospace and Arconic after corporate restructuring) is a key player in the development and commercialization of Al-Li powders tailored for additive manufacturing. The company’s expertise in alloy design and powder production is critical for ensuring the consistency and quality required for aerospace-grade components. Alcoa’s strategic initiatives include expanding its AM powder portfolio, collaborating with OEMs on qualification programs, and investing in process optimization to enable cost-effective, high-volume production of Al-Li AM parts (Alcoa).

Looking ahead, the next few years are expected to see increased collaboration between OEMs, materials suppliers, and AM technology developers. The focus will be on accelerating the qualification of Al-Li AM components, expanding the range of printable alloys, and integrating digital manufacturing workflows. These efforts are poised to unlock new design possibilities and further cement Al-Li alloys as a cornerstone of advanced aerospace manufacturing.

Material Properties and Performance Advantages

Aluminum-lithium (Al-Li) alloys have emerged as a transformative material class in additive manufacturing (AM), particularly for aerospace and high-performance engineering applications. The unique combination of low density, high specific strength, and improved fatigue and corrosion resistance makes Al-Li alloys highly attractive for weight-sensitive structures. In 2025, the integration of Al-Li alloys into AM processes is accelerating, driven by both material suppliers and end-users seeking to exploit these performance advantages.

Recent developments have focused on optimizing powder characteristics and process parameters to address the challenges of printing Al-Li alloys, such as hot cracking and oxidation. Companies like Constellium and Arconic—both recognized leaders in advanced aluminum alloys—have expanded their research and supply of Al-Li powders tailored for laser powder bed fusion (LPBF) and directed energy deposition (DED) systems. These powders are engineered for high flowability, controlled particle size distribution, and minimal oxide content, which are critical for achieving dense, defect-free parts.

Material property data from 2024 and early 2025 indicate that additively manufactured Al-Li alloys can achieve up to 10% lower density and 15% higher specific stiffness compared to conventional Al-Cu or Al-Mg alloys, while maintaining comparable or superior fatigue performance. For example, aerospace-grade Al-Li alloys such as 2195 and 2050, when processed via AM, have demonstrated yield strengths exceeding 400 MPa and elongations above 8%, rivaling wrought counterparts. These properties are particularly valuable for aerospace structures, where every percentage of weight reduction translates to significant fuel savings and payload increases.

Another key advantage is the ability to fabricate complex, topology-optimized geometries that are not possible with traditional manufacturing. This enables further weight reduction and performance gains, as seen in prototype components developed by Airbus and Boeing in collaboration with material suppliers. Both companies have publicly committed to expanding the use of AM Al-Li alloys in next-generation airframes and space systems, citing improved buy-to-fly ratios and reduced lead times.

Looking ahead to the next few years, ongoing research is expected to further enhance the printability and post-processing of Al-Li alloys, including the development of new alloy chemistries and heat treatment protocols. Industry bodies such as SAE International are actively working on standardizing material specifications and qualification procedures for AM Al-Li alloys, which will accelerate broader adoption across aerospace, defense, and automotive sectors. As these standards mature and supply chains scale, the performance advantages of Al-Li alloy additive manufacturing are poised to become a cornerstone of lightweight, high-strength component production.

Adoption Drivers: Aerospace, Automotive, and Emerging Sectors

The adoption of aluminum-lithium (Al-Li) alloy additive manufacturing (AM) is accelerating in 2025, driven by the aerospace, automotive, and emerging sectors seeking lightweight, high-performance components. Al-Li alloys are prized for their superior strength-to-weight ratio, corrosion resistance, and fatigue performance, making them highly attractive for industries where weight reduction translates directly into fuel savings and emissions reductions.

In aerospace, the push for next-generation aircraft and space vehicles is a primary driver. Major OEMs and suppliers are actively exploring Al-Li AM to produce complex, topology-optimized structures that are difficult or impossible to fabricate using traditional methods. For example, Airbus has publicly committed to expanding its use of additive manufacturing for structural components, and Al-Li alloys are a focus due to their established use in advanced airframes. Similarly, Boeing continues to invest in AM for both commercial and defense applications, with Al-Li alloys under evaluation for critical load-bearing parts.

The automotive sector is also ramping up interest, particularly among high-performance and electric vehicle manufacturers. The need to offset battery weight and improve vehicle range is pushing automakers to adopt lighter materials. Companies such as BMW Group and Tesla are known for their early adoption of AM technologies and are actively investigating Al-Li alloys for chassis and structural applications. The ability to rapidly prototype and produce custom, lightweight parts is especially valuable in motorsports and luxury segments, where performance gains are closely tied to material innovation.

Emerging sectors, including space launch providers and advanced UAV manufacturers, are also significant adopters. The space industry, led by companies like SpaceX and Blue Origin, is leveraging Al-Li AM for rocket structures and fuel tanks, where every kilogram saved can reduce launch costs. The defense sector, represented by organizations such as Lockheed Martin, is exploring Al-Li AM for lightweight, high-strength components in next-generation platforms.

Looking ahead, the outlook for Al-Li alloy AM adoption is robust. As powder suppliers such as Advanced Metal Powder Federation and machine manufacturers like EOS and GE continue to refine process parameters and material quality, barriers to widespread industrialization are expected to diminish. The convergence of digital design, advanced simulation, and AM is poised to unlock new applications across sectors, with Al-Li alloys at the forefront of lightweighting strategies through 2025 and beyond.

Challenges: Printability, Cost, and Supply Chain Constraints

Aluminum-lithium (Al-Li) alloys are highly valued in aerospace and advanced engineering for their exceptional strength-to-weight ratio and corrosion resistance. However, their adoption in additive manufacturing (AM) faces significant challenges in 2025 and the near future, particularly regarding printability, cost, and supply chain constraints.

Printability remains a primary technical hurdle. Al-Li alloys are notoriously difficult to process via powder bed fusion and directed energy deposition due to their high reactivity, tendency for hot cracking, and sensitivity to process parameters. The low density and high volatility of lithium complicate powder production and handling, often resulting in inconsistent powder quality and increased risk of contamination. Leading AM system manufacturers such as EOS and 3D Systems have made progress in optimizing process parameters for aluminum alloys, but commercial solutions for Al-Li remain limited. Research collaborations with aerospace OEMs and powder suppliers are ongoing to develop tailored process windows and post-processing treatments, but widespread industrialization is not expected before 2027.

Cost is another significant barrier. Lithium is a critical and relatively scarce element, with prices subject to volatility due to demand from the battery sector. The production of high-quality Al-Li powders suitable for AM is more expensive than conventional aluminum alloys, driven by the need for inert gas atomization, strict quality control, and specialized storage to prevent oxidation. Companies such as Advanced Metal Powder Fabrication and Tekna are investing in scalable powder production, but as of 2025, Al-Li powders remain niche and command a premium price. This cost factor limits adoption to high-value applications, primarily in aerospace and defense.

Supply chain constraints further complicate the outlook. The supply of lithium is dominated by a handful of mining and chemical processing companies, and the majority of lithium is allocated to battery manufacturing for electric vehicles and energy storage. This creates competition for raw materials and potential bottlenecks for the AM sector. Additionally, the number of qualified suppliers for Al-Li AM powders is limited, with only a few companies—such as APWORKS and Tekna—offering commercial-scale production. Certification and traceability requirements in aerospace add further complexity, slowing down the qualification of new suppliers and materials.

Looking ahead, the industry is investing in R&D to address these challenges, with a focus on alloy design, process optimization, and recycling of Al-Li scrap. However, until breakthroughs in powder production and supply chain resilience are achieved, the widespread adoption of Al-Li alloys in additive manufacturing will remain constrained to specialized, high-performance applications.

Recent Innovations and R&D Trends [Sources: nasa.gov, tms.org]

Aluminum-lithium (Al-Li) alloys have long been valued in aerospace and high-performance engineering for their exceptional strength-to-weight ratio and corrosion resistance. In 2025, additive manufacturing (AM) of Al-Li alloys is experiencing a surge in research and innovation, driven by the need for lighter, more efficient structures in space, aviation, and advanced transportation sectors. Recent R&D efforts are focused on overcoming the unique challenges posed by Al-Li alloys in AM, such as hot cracking, lithium volatility, and achieving consistent microstructure and mechanical properties.

A major area of innovation is the development of new powder compositions and process parameters tailored for laser powder bed fusion (LPBF) and directed energy deposition (DED) techniques. Researchers at NASA have reported progress in optimizing print parameters to minimize porosity and cracking in Al-Li parts, enabling the production of complex geometries previously unattainable with traditional manufacturing. NASA’s work is also exploring the integration of in-situ monitoring and feedback control to ensure quality and repeatability in critical aerospace components.

The The Minerals, Metals & Materials Society (TMS) has highlighted collaborative projects between industry and academia aimed at understanding the relationship between AM process variables and the resulting microstructure of Al-Li alloys. These efforts are leading to the development of predictive models that can guide alloy design and process optimization, accelerating the qualification of AM Al-Li parts for flight applications.

On the industrial front, major aerospace manufacturers and material suppliers are investing in proprietary Al-Li alloy powders and AM process solutions. Companies such as Airbus and Boeing are actively exploring the use of AM Al-Li components in next-generation aircraft structures, seeking to reduce weight and improve fuel efficiency. Powder producers like AMETEK Specialty Metal Products are scaling up production of high-purity Al-Li powders with controlled particle size distributions, which are critical for consistent AM performance.

Looking ahead, the outlook for Al-Li alloy additive manufacturing is promising. Ongoing R&D is expected to yield new alloy formulations specifically engineered for AM, with enhanced printability and post-processing characteristics. The next few years will likely see the first certified Al-Li AM parts entering service in aerospace and defense, supported by robust qualification frameworks and digital twins for lifecycle management. As the technology matures, broader adoption in automotive and energy sectors is anticipated, further driving innovation and supply chain development.

Regulatory Standards and Certification Pathways [Sources: faa.gov, easa.europa.eu]

The regulatory landscape for aluminum-lithium (Al-Li) alloy additive manufacturing (AM) is evolving rapidly as aerospace and other high-performance sectors seek to leverage the material’s unique properties—such as high strength-to-weight ratio and corrosion resistance—through advanced manufacturing techniques. In 2025, both the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) are actively updating and refining certification pathways to address the specific challenges and opportunities presented by AM of Al-Li alloys.

The FAA continues to expand its guidance for additive manufacturing, building on its previously released Advisory Circulars and policy statements. In 2025, the agency is expected to further clarify requirements for process qualification, material property validation, and part certification for Al-Li alloys produced via AM. This includes a focus on ensuring repeatability, traceability, and robust non-destructive evaluation (NDE) methods, which are critical for safety-critical aerospace components. The FAA is also working closely with industry stakeholders and standards organizations to harmonize requirements and facilitate the adoption of AM parts in commercial aviation.

Similarly, EASA is advancing its regulatory framework for AM, with particular attention to metallic materials such as Al-Li alloys. EASA’s approach emphasizes a risk-based assessment, requiring manufacturers to demonstrate equivalency or superiority of AM-produced parts compared to conventionally manufactured counterparts. In 2025, EASA is expected to release updated guidance on the certification of AM processes and materials, including specific provisions for Al-Li alloys. This will likely include requirements for process control, material traceability, and in-service monitoring, reflecting the agency’s commitment to maintaining high safety standards while enabling innovation.

Both agencies are increasingly recognizing the importance of international harmonization of standards. Collaborative efforts with organizations such as ASTM International and SAE International are ongoing to develop consensus-based standards for AM of Al-Li alloys. These standards are expected to address key aspects such as powder quality, process parameters, mechanical property testing, and post-processing requirements.

Looking ahead, the regulatory outlook for Al-Li alloy AM is one of cautious optimism. While certification pathways are becoming clearer, manufacturers must invest in rigorous process validation and documentation to meet evolving requirements. The next few years will likely see the first fully certified Al-Li AM components entering service in commercial and defense aerospace, setting important precedents for broader adoption. Ongoing dialogue between regulators, industry, and standards bodies will be essential to ensure that certification keeps pace with technological advances, supporting the safe and effective integration of Al-Li AM into critical applications.

Future Outlook: Disruptive Potential and Strategic Recommendations

The future outlook for aluminum-lithium (Al-Li) alloy additive manufacturing (AM) in 2025 and the coming years is marked by both disruptive potential and strategic imperatives for stakeholders across aerospace, automotive, and advanced manufacturing sectors. Al-Li alloys, prized for their high strength-to-weight ratio and superior fatigue resistance, are increasingly seen as a key enabler for next-generation lightweight structures, particularly in aerospace applications.

Recent years have witnessed significant investments and technical milestones in the AM of Al-Li alloys. Major aerospace OEMs and material suppliers are actively developing proprietary Al-Li powders and process parameters tailored for powder bed fusion (PBF) and directed energy deposition (DED) systems. For example, Airbus has publicly emphasized the strategic importance of Al-Li alloys in its aircraft structures, and is exploring AM routes to further reduce component weight and lead times. Similarly, Boeing continues to invest in additive manufacturing for critical structural parts, with Al-Li alloys being a focus due to their performance benefits.

On the materials side, suppliers such as Constellium and Arconic are advancing the development of AM-optimized Al-Li powders, addressing challenges such as hot cracking and porosity that have historically limited the printability of these alloys. These companies are collaborating with machine manufacturers and end-users to refine alloy chemistries and process windows, aiming for qualification in high-value aerospace and defense applications.

The disruptive potential of Al-Li alloy AM lies in its ability to enable complex, topology-optimized geometries that are not feasible with traditional subtractive methods. This could lead to substantial reductions in part count, assembly complexity, and overall airframe weight—translating to improved fuel efficiency and lower emissions. As regulatory and sustainability pressures mount, the adoption of AM for Al-Li components is expected to accelerate, especially as qualification pathways mature and in-service data accumulates.

Strategically, companies are advised to invest in collaborative R&D, digital qualification frameworks, and supply chain integration to capture early-mover advantages. Partnerships between OEMs, powder suppliers, and AM machine manufacturers—such as those seen between GE Aerospace and leading powder producers—are likely to proliferate. Furthermore, the emergence of digital twins and in-situ monitoring technologies will be critical for ensuring quality assurance and regulatory compliance in safety-critical applications.

In summary, the next few years will be pivotal for the industrialization of Al-Li alloy additive manufacturing. Stakeholders who prioritize material innovation, process qualification, and ecosystem collaboration will be best positioned to capitalize on the disruptive potential of this technology as it transitions from pilot projects to serial production.

Sources & References

- Airbus

- Boeing

- Constellium

- AMG Advanced Metallurgical Group

- Kymera International

- NASA

- EOS

- GE

- Arconic

- 3D Systems

- Siemens

- APWORKS

- TRUMPF

- Alcoa

- Blue Origin

- Lockheed Martin

- Tekna

- European Union Aviation Safety Agency